-

任务型阅读

Green finance is a phenomenon that combines the world of finance and business with environmentally friendly behavior.It is a stage for many participants, including individual and business consumers, producers investors,and financial lenders.Green finance can be expressed differently depending on the participants' financial incentives(动机) , desires to preserve the planet, or a combination of both.In addition to showing environmentally friendly behavior,such as promoting mass transit or the recycling of used goods, green finance is about preventing the promotion of any business or activity that could do damage to the environment now or future generations.

Financial institutions that extend lending to individuals, small businesses,or large corporations can do so in an environmentally friendly manner.In this type of green finance,loans are used for the proliferation(扩散) of renewable energy, for instance.A lender could finance the development of a solar power plant that generates power from the sun and panels installed on the roof of a building or residence.Wind power generation is another of business that would get support from green financiers.These com panes develop expensive wind farms that use large turbines onshore and of shore to capture the wind and generate energy.

Energy producers, who use fossil flues,including coal, are not likely to participate in any type of green finance.Coal is a traditional power source that release emissions into the air,substances that are largely considered harmful to the environment. As a result,a coal producer is the type of company that a green financer would likely avoid.

Offering environmental incentives to market participants is a useful way to drive the development of green businesses. Small businesses that are not even in the business of clean energy can participate because this is an extremely proactive(主动的)form of green financing. For instance, a company that sells vehicles may focus on selling cars that are designed to use a hybrid fuel combining both fossil fuels and renewable energy. This business might offer customers an incentive to purchase a car, for example, and in exchange for every vehicle that is sold, the dealer will purchase and plant a tree to promote a clean environment.

Venture capital its(风险投资者) , or firms that extend financing to start up companies for growth, participate in green finance in an active way. Many firms are behind emerging technologies clean energy that are expected to produce a greater portion of the world's power in the future.Venture capitalists specialize in risky and emerging technologies and as a result, tend to have a hand in green financing.

Passage outline

Supporting details

1. to green finance

◆It refers to the 2. of the world of finance and business with environmentally friendly behavior.

◆It functions 3. according to its participants' financial incentives,desires to preserve the plant or a combination of both.

◆It involves promoting mass transit, recycling and preventing the business on activity that does 4. harm to the environment.

Benefits of green

finance

◆Individuals,small businesses,or large corporations can get 5. from green financial institutions.

◆It is aimed at 6. renewable energy and wind power generation.

◆However, energy producers, like a coal producer that pollute air, will be 7. out in any type of green finance.

Ways to develop green finance

◆Offering environmental incentives to market participants can 8. to the development of green finance.

◆Venture capitalists,or firms 9.participate in green finance to help star-up companies.

◆Venture capitalists who are 10. in the risky and emerging technologies are likely to take part in green financing.

高三英语任务型阅读困难题查看答案及解析

-

任务型阅读

What is positive thinking? You might be tempted to assume that it implies seeing the world through rose-colored lenses by ignoring the negative aspects of life. However, positive thinking actually means approaching life's challenges with a positive outlook. It does not necessarily mean avoiding or ignoring the bad things; instead, it involves making the most of potentially bad situations, trying to see the best in other people, and viewing yourself and your abilities in a positive light.

Some researchers often frame positive thinking in terms of explanatory style. Your explanatory style is how you explain why events happened. People with an optimistic explanatory style tend to give themselves credit when good things happen, but typically blame outside forces for bad outcomes. Unlike individuals with a pessimistic explanatory style they also seldom view negative events as expected and lasting. Positive thinkers are more likely to use an optimistic explanatory style, but the way in which people attribute events can also vary depending upon the exact situation. For examples, a person who is generally a positive thinker might use a more pessimistic explanatory style in particularly challenging situations, such as at work or at school.

In recent years, the so-called "power of positive thinking" has gained a great deal of attention. Empirical (经验的) research has found that there are a lot of very real health benefits linked to positive thinking and optimistic attitudes. For example, positive thinking can make one live longer, feel less depressed, become less likely to suffer from health problems like the common cold and cardiovascular disease-related death. But why exactly does positive thinking have such a strong impact on health? One theory is that people who think positively tend to live a healthier life in general; they may exercise more, follow a more nutritious (营养的) diet and avoid unhealthy behaviors.

Even if you are not a natural-bom optimist, there are things you can do to learn how to think positively. For example, you are supposed to focus on your own inner monologue (独白) and stay away from negative self-talk.

When you are facing challenges and start engaging in negative thinking, call a friend of family member who you can count on to offer positive encouragement and feedback. Overall, remember that to think positively, you need to nurture (滋养) yourself. Investing energy in things you enjoy and surrounding yourself with optimistic people are just two ways that you can encourage positive thinking in your life.

Passage Outline

Supporting details

Concept

Positive thinking refers to an attitude of approaching challenges, which doesn't mean escaping from bad things but taking 1.of them.

Characteristics of positive thinkers

♦ Positive thinkers reward themselves for good outcomes while they do not 2. themselves when bad things happen.

♦They tend to regard negative events as unexpected and3. .

♦ They are likely to 4.with some challenging situations in a pessimistic way.

Benefits and possible reasons

♦ Positive thinking helps 5. peopled lifespan, manage depression and improve people's ability to 6. disease.

♦ People who think positively tend to live 7..

Tips

♦ 8. negative self-talk and when experiencing trouble.

♦Turn to a(n)9. person for positive encouragement and feedback.

♦ 10. yourself to interesting things and spend time with optimistic people.

高三英语任务型阅读中等难度题查看答案及解析

-

The phenomenon is becoming more and more popular that human beings have developed a closely relationship with the most dangerous of animals-Kevin Richardson treats lions like kitty cats,Andre Hartman has a special bond with Great White Sharks and now there is 79year old Werner Freund who has spent the last 40 years of his life in the company of wolves.

While details about how and why the former paratrooper(伞兵) became attached to these beautiful wild animals are a little summary,he has been tending them in his 25acre Wolvespark located in the German province of Saarland,since 1972.While he currently has a group of 29,over the years he has raised almost 70 wolves belonging to all breeds(种属) ranging from Siberian to Arctic,Canadian,European and even,Mongolian.The wolves treat Werner as if he were one of their own.They nuzzle(依偎) against him,play with him and are generally sheeplike when he is around,just like they would be around a head wolf!

This,however,is not accidental-It is a position that Werner works on establishing and maintaining with a simple act,every single day-Whenever it's feeding time,he calls his wolves to come for the raw meat by howling.As the hungry animals rush to get their food,they are always met with this scene-Werner sinking his teeth into the raw meat first.While this may sound a little rude,that is how the position of hierarchy(等级) is established in the animal world.It is always the leader male that gets the first meal and only when he signals,can the rest join in.Werner's wolves know this rule quite well and never challenge his authority.

While wolves,the largest member of the dog family,are believed to be dangerous,they rarely attack humans.Werner says that in reality,they are beautiful gentle souls,whose reputation has been tarnished,by fairy tales like Red Riding Hood!

1.We can know________from the first paragraph.

A.all lions like Kevin Richardson

B.Great White Sharks are dangerous animals

C.only some specialists can live animals together

D.Werner Freund accompanies wolves day and night

2.What's the best title of the passage?

A.Human beings can get along well with animals

B.Werner Freund and his famous Wolvespark

C.Werner Freund treats his wolves like friends

D.Exparatrooper shares special bond with wolves

3.We can infer that the wolves treat Werner Freund________.

A.peacefully B.respectfully C.fearfully D.fondly

4.When Werner Freund feeds his wolves,________.

A.he whistles loudly

B.he bites the meat firstly

C.wolves challenge his authority

D.wolves eat all their foods.

高三英语阅读理解简单题查看答案及解析

-

Boxwars is a fast-growing entertainment phenomenon that takes the childhood pastime of playing with cardboard boxes to a whole new level. Participants use cardboard to create weapons, trucks, tanks, huge animals and so on. Then they put on monumental battle shows during which every creation is completely destroyed!

Boxwars is the brainchild of Australian friends Hoss Siegel and Ross Koger, who came up with it nearly a decade ago over drinks. They did it at a party and had a great time, and then they decided to do it again.

With each new boxwar party, the suits and structures became more and more carefully prepared until they couldn't fit in their back gardens any more. So they moved the party to a local park on Boxing Day 2002, and people who were having barbecues at the park rushed over to watch them. And that's when they realized that their silly games actually had huge entertainment value.

That was the beginning of Boxwars. They go to the same spot every year on Boxing day.

Today, Boxwars builds complex structures for each themed battle. The sport has expanded beyond Boxing Day — it is now a part of nearly every major festival or event in Australia and around the world.

Boxwars is now run by the Boxwars Council, and has lots of fans across the globe. “One of our main aims is to bring cardboard back to the consumers who deserted it in the first place without realising its true potential,” the official website states. “Cardboard, or the street name ‘box’, we quickly discovered had brilliant properties for engineering. The limits of scale and awesomeness were continuously pushed to greater commanding heights with the development of our skills with this great thing.”

1.What can we infer about Boxwars?

A.America is its birthplace.

B.It is considered to be a waste of money.

C.Its first appearance was on Boxing Day 2002.

D.All the weapons made for it will be destroyed.

2.What is a main purpose mentioned in the text to run Boxwars?

A.To prepare people for possible war.

B.To exercise children’s ability of using hands.

C.To make people realize the use of deserted box.

D.To provide a chance to satisfy people's curiosity.

3.What did Hoss Siegel and Ross Koger think of their idea of Boxwars at first?

A.Significant and popular. B.Fun but foolish.

C.Interesting but expensive. D.Challenging but beneficial.

4.What might be the best title for the text?

A.Boxwars — a creative design B.Boxwars — a popular game

C.Boxwars — a new kind of box D.Boxwars — a fierce competition

高三英语阅读理解中等难度题查看答案及解析

-

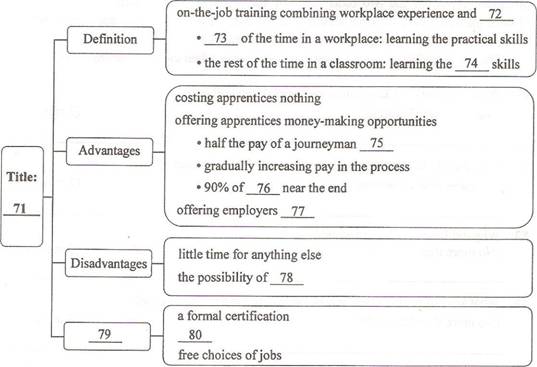

An apprenticeship is a form of on-the-job training that combines workplace experience and classroom learning. It can last anywhere from one to six years, but four years is typical for most. An apprentice spends the majority of the time in a workplace environment learning the practical skills of a career from a journeyman--someone who has done the job for many years. The rest of the apprentice's time is spent in a classroom environment learning the theoretical skills the career requires. Being an apprentice is a full-time undertaking.

One of the advantages of apprenticeship is that it does not cost apprentices anything. The companies that hire them pay for school. What's more, it offers apprentices an "earn while you learn" opportunity. They usually start out at half the pay of a journeyman, and the pay increases gradually as they move further along in the job and studies. Near the end of the apprenticeship, their wages are usually 90 percent of what a journeyman would receive. Apprenticeship also pays off for employers. It can offer employers a pool of well-trained workers to draw from.

Despite the advantages, apprentices are usually required to work during the day and attend classes at night, which leaves little time for anything else. Sometimes, they might be laid off(下岗) if business for the employers is slow.

Once they have completed the apprenticeship and become journeymen, they receive a nationally recognized and portable certification and their pay also increases again. Some journeymen continue employment with the companies they apprenticed with; others go onto different companies or become self-employed contractors.

高三英语填空题中等难度题查看答案及解析

-

TOKYO—A child-like robot that combines the roles of nurse, companion and security guard is to go on the market to help the growing ranks of elderly Japanese with no one to look after them.

The “Wakamaru” robot can walk around a house 24 hours a day, warning family, hospitals and security firms if it perceives (notices) a problem. It will, for example, call relatives if the owner fails to get out of the bath.

Cameras implanted in the “eye-brows” of the robot enable it to “see” as it walks around an apartment. The images can be sent to the latest cellphones, which display the pictures.

Mitsubishi Heavy Industries, which developed Wakamaru, plans to start selling the metre-high robots by April, 2005, for about $15,000 Cdn.

Wakamaru, which speaks with either the voice of a boy or girl, is also designed to provide companionship, greeting its “papa” when he comes home.

It is the first household robot able to hold simple conversations, based on a vocabulary of around 10,000 words. It cannot only speak but can understand answers and react accordingly.

It will ask “Are you all right ?” if its owner does not move for some time. If the answer is no, or there is no answer, it will telephone preset numbers, transmitting images and functioning as a speakerphone.

Wakamaru will inform a security firm if there is a loud bang or if an unknown person enters the house while the owner is out or asleep. It can recognize up to 10 faces.

But like most robots it cannot climb stairs.

It can be set to remind forgetful people when it is time to take medicine, eat and sleep.

Mitsubishi adapted Wakamaru from robots it already makes to go around nuclear power facilities. The idea to use the technology in the home came from a company employee.

The project chief said :“Looking at the ageing of society and the falling birth rate we decide that this could work as a business. We want to offer Wakamaru as a product that helps society.”

The technology has gained nation-wide publicity in Japan among increasing concern over how to look after the ever-growing number of old people. The life expectancy of Japanese women has shot up to almost 85, the highest in the world.

At the same time, extended families are being replaced by nuclear families. This has left many Japanese anxious about their elderly parents, whom they rarely see because of their long hours at the office.

1.Which of the following is true about the Robot?

A. It is used in some nuclear power facilities.

B. It cannot speak but can understand answers.

C. It can go up and down the stairs easily. D. It can recognize as many as 10 faces.

2.The purpose of this passage is ________.

A. to introduce a new product B. to solve the aging problems

C. to tell people how to use the robot D. to show the rapid development of technology

3.What can we infer from the passage ?

A. The robot can dial proper numbers for help.

B. The robot is likely to have a promising market.

C. The robot has given the Japanese a chance to live longer.

D. The nuclear families have left many elderly Japanese anxious.

4.What is the best title of this passage ?

A. The Latest Development of Robot Technology B. Japanese Robot and the Aging Society

C. Vast Market of the New Robot D. Japanese-built Robot to Help the Old

5. Wakamaru _____________________.

A. is a child who is always taking good care of his grandparents 24 hours a day.

B. has a vocabulary of around 1,000 words

C. is the first household robot that has ever been produced.

D. has ameras implanted in the “eye-brows” which enable it to “see” when walking.

高三英语阅读理解简单题查看答案及解析

-

Welcome to one of the largest collections of footwear(鞋类)in the world that will make you green with envy. Here at the Footwear Museum you can see exhibits(展品)from all over the world. You can find out about shoes worn by everyone from the Ancient Egyptians to pop stars.

Room 1

The celebrity(名人)footwear section is probably the most popular in the entire museum. Started in the 1950s there is a wide variety of shoes and boots belonging to everyone from queens and presidents to pop stars and actors! Most visitors find the celebrities' choice of footwear extremely interesting.

Room 2

Most of our visitors are amazed—and shocked—by the collection of “special purpose” shoes on exhibition here at the Museum of Footwear. For example, there are Chinese shoes made of silk that were worn by women to tie their feet firmly to prevent them from growing too much!

Room 3

As well as shoes and boots, the museum also exhibits shoeshaped objects. The variety is unbelievable. For example, there is a metal lamp that resembles a pair of shoes, and Greek wine bottles that look like legs!

The Footwear Library

People come from all over the world to study in our excellent footwear library. Designers and researchers come here to look up information on anything and everything related to the subject of footwear.

1.Where would you find a famous singer's shoes?

A.Room 1.

B.Room 2.

C.Room 3.

D.The Footwear Library.

2.All exhibits each room ________.

A.share the same theme

B.have the same shape

C.are made of the same material

D.belong to the same social class

3.Which of the following is true according to the text?

A.The oldest exhibits in Room 1 were made in the 1950s.

B.Room 2 is the most visited place in the museum.

C.Room 3 has a richer variety of exhibits than the other two.

D.Researchers come to the Footwear Library for data. (资料,数据)

4.The purpose of the text is to get more people to ________.

A.do research

B.design shoes

C.visit the museum

D.follow celebrities

高三英语阅读理解简单题查看答案及解析

-

Welcome to one of the largest collections of footwear(鞋类)in the world that will make you green with envy. Here at the Footwear Museum you can see exhibits(展品)from all over the world. You can find out about shoes worn by everyone from the Ancient Egyptians to pop stars.

Room 1

The celebrity(名人)footwear section is probably the most popular in the entire museum. Started in the 1950s there is a wide variety of shoes and boots belonging to everyone from queens and presidents to pop stars and actors! Most visitors find the celebrities’ choice of footwear extremely interesting.

Room 2

Most of our visitors are amazed

—and shocked— by the collection of “special purpose”shoes on exhibition here at the Museum of Footwear. For example, there are Chinese shoes made of silk, that were worn by women to tie their feet firmly to prevent them from growing too much!

Room 3

As well as shoes and boots the museum also exhibits shoe-shaped objects. The variety is unbelievable. For example, there is a metal lamp that resembles a pair of shoes, and Greek wine bottles that like legs!

The footwear Library

People come from all over the world to study in our excellent footwear library. Designers and researchers come here to look up information on anything and everything related to the subject of footwear.

1.Where would you find a famous singer’s shoes?

A. Room1. B. Room 2. C. Room 3 D.The footwear Library

2.All exhibits in each room ________________ .

A. share the same theme B. have the same shape

C. are made of the same material D. belong to the same social class

3.Which of the following is true according to the text?

A. The oldest exhibits in Room 1 were made in the 1950s.

B. Room 2 is the most visited place in the museum.

C. Room 3 has a richer variety of exhibits than the other two.

D. Researchers come to the Footwear Library for data.

4.The purpose of the text is to get more people to __________________.

A. do research B. design shoes

C. visit the museum D. follow celebrities

高三英语阅读理解中等难度题查看答案及解析

-

Welcome to one of the largest collections of footwear (鞋类) in the world that will make you green with envy. Here at the Footwear Museum you can see exhibits (展品) from all over the world. You can find out about shoes worn by everyone from the Ancient Egyptians to pop stars.

Room 1

The celebrity (名人) footwear section is probably the most popular in the entire museum. Started in the 1950s, there is a wide variety of shoes and boots belonging to everyone from queens and presidents to pop stars and actors! Most visitors find the celebrities' choice of footwear extremely interesting.

Room 2

Most of our visitors are amazed and shocked by the collection of "special purpose" shoes on exhibition here at the Museum of Footwear. For example, there are Chinese shoes made of silk that were worn by women to tie their feet firmly to prevent them from growing too much!

Room 3

As well as shoes and boots, the museum also exhibits shoe-shaped objects. The variety is unbelievable. For example, there is a metal lamp that resembles a pair of shoes, and Greek wine bottles that like legs!

The Footwear Library

People come from all over the world to study in our excellent footwear library. Designers and researchers come here to look up information on anything and everything related to the subject of footwear.

1.What can you find in Room 1? ______

A.Chinese special purpose shoes.

B.Queens' boots.

C.Metal lamps.

D.Bottles of Greek wine.

2.What can we know about Room 2? ______

A.It is the most visited place in the museum.

B.It has a richer variety of exhibits than the other two.

C.It has the oldest exhibits than the other two.

D.It mainly exhibits shoes that have some special purposes.

3.Where can you find some data that have something to do with the subject of footwear? ______

A.In the Footwear Library. B.In Room 1

C.In Room 2 D.In Room 3

高三英语阅读理解简单题查看答案及解析

-

Welcome to one of the largest collections of footwear(鞋类)in the world that will make you green with envy. Here at the Footwear Museum you can see exhibits(展品)from all over the world.You can find out about shoes worn by everyone from the Ancient Egyptians to pop stars.

Room 1

The celebrity(名人)footwear section is probably the most popular in the entire museum.Started in the 1950s, there is a wide variety of shoes and boots belonging to everyone from queens and presidents to pop stars and actors! Most visitors find the celebrities' choice of footwear extremely interesting.

Room 2

Most of our visitors are amazed and shocked by the collection of "special purpose" shoes on exhibition here at the Museum of Footwear.For example,there are Chinese shoes made of silk that were worn by women to tie their feet firmly to prevent them from growing too much!

Room 3

As well as shoes and boots,the museum also exhibits shoe-shaped objects.The variety is unbelievable.For example,there is a metal lamp that resembles a pair of shoes,and Greek wine bottles that like legs!

The Footwear Library

People come from all over the world to study in our excellent footwear library.Designers and researchers come here to look up information on anything and everything related to the subject of footwear.

1.What can you find in Room 1?

A. Queens' boots. B. Chinese special purpose shoes.

C. Metal lamps. D. Bottles of Greek wine.

2.What can we know about Room 2?

A. It is the most visited place in the museum.

B. It has a richer variety of exhibits than the other two.

C. It mainly exhibits shoes that have some special purposes.

D. It has the oldest exhibits than the other two.

3.Where can you find some data that have something to do with the subject of footwear?

A. In Room 1. B. In Room 2.

C. In Room 3. D. In the Footwear Library.

4.What is the purpose of the passage?

A. To tell people how to follow celebrities.

B. To call on people to do research on shoes.

C. To get more people to pay a visit to the museum.

D. To show people the way to design shoes.

高三英语阅读理解中等难度题查看答案及解析